The post Breaking: Ethereum’s Exchange Depositing Transactions Hit 6-Year Low! Will ETH Price Now Aim For $2K? appeared first on Coinpedia Fintech News

The Ethereum network, the second-largest cryptocurrency by market cap, has recently witnessed an unusual but noteworthy trend. For the first time in 6 years, the number of Ethereum’s exchange depositing transactions has dropped to an all-time low. The question on every trader, investor, and enthusiast’s mind is: “What does this mean for Ethereum’s (ETH) price? Could it be a springboard for a leap towards the $2,000 mark?”

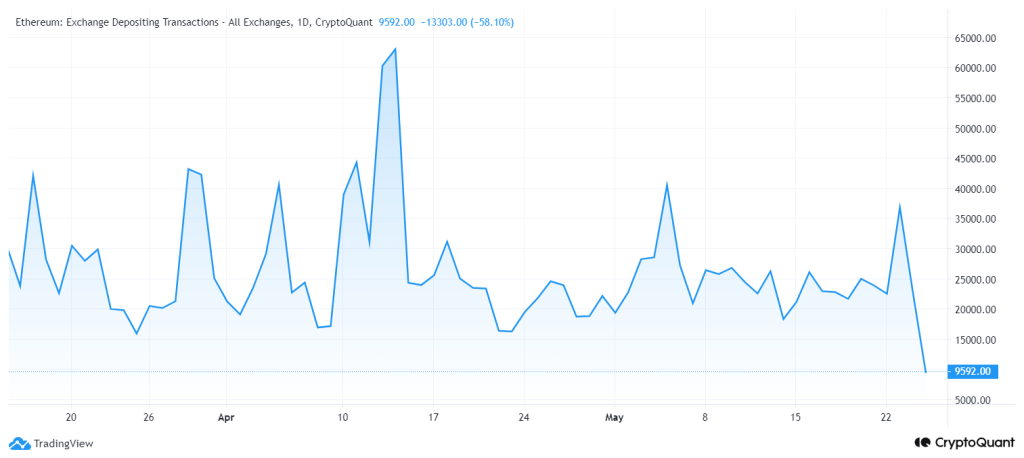

Ethereum’s Exchange Depositing Transactions Reach 2017 Levels

As uncertainties surrounding the US debt ceiling and potential interest rate hikes weigh heavily on the cryptocurrency market, leading assets such as Bitcoin and Ethereum find themselves struggling to provide a definitive outlook. Nevertheless, our examination suggests a burgeoning bullish sentiment poised to propel the price of ETH on an upward trajectory.

Upon close inspection of Ethereum’s exchange depositing transactions, we’ve noted a significant multi-year trough today, bottoming out at 9,592 transactions. This is a noteworthy observation as this same level was last experienced on April 23, 2017, right before Ethereum embarked on its inaugural bull run, touching the $1000 mark.

The number of exchange depositing transactions is a critical data point for crypto analysis. This metric provides a reliable indication of potential sell-offs or price pressures. A high number of deposit transactions usually signals an impending sell-off as more holders are moving their assets onto exchanges.

Conversely, a low number suggests that holders are withdrawing their assets, indicating a bullish sentiment as investors show less interest in selling their ETH holdings.

“The observed resurgence in the price of Ethereum is indeed significant, possibly indicating a bullish phase in the coming months. The marked decrease in deposit transactions ultimately signals a positive outlook for the asset.”

What To Expect From ETH Price Next?

Despite opening this week with a positive rally, Ethereum encountered a firm rejection close to the $1,870 mark. Following this, ETH’s value has been on a downward spiral, finding a safety net at the $1,760 level. Nevertheless, Ethereum’s latest bounce back from its support threshold, paired with its ascension past immediate Fibonacci levels, has rekindled bullish optimism.

As of writing, ETH price trades at $1,802, surging over 0.15% in the last 24 hours. Analyzing the 4-hour price chart, Ethereum experienced significant buying pressure today at $1,780, sending the price to an intraday high of $1,812.

If the ETH price continues to hold its current momentum and breaks above its immediate hurdle of EMA50 at $1,815, the asset might surge to its next resistance of $1,877. A breakout above its final resistance will clear the road to $2K.

Conversely, any unfavorable economic indicators could serve as the trigger, driving the ETH price beneath the vital support level of $1,750.