The post Ethereum Is Going For A Retest Of $2,100! Will ETH Price Succeed This Time? appeared first on Coinpedia Fintech News

This week began with a surge in the market, with Bitcoin breaking past $37,000 and Ethereum regaining strength, reaching the $2,000 level. Amidst Ethereum’s quiet buildup near its recent low, the anticipation of retesting the $2.1K level is growing, sparking concerns of a potential big shift triggered by substantial liquidations.

Whales Made Silent Accumulation

Ethereum’s price experienced an unexpected rally, climbing above $2,000, leading to significant liquidations, as shown by Coinglass data. This surge resulted in the liquidation of around $16 million in short positions as the price moved against sellers’ bearish expectations below $1,900.

Ethereum’s recent price dips, which seemed concerning to some, were being seen as buying opportunities by whales. They were increasing their holdings, as shown by the rise in addresses with over 10,000 ETH, valued at around $20 million. This is the first time in two months that whales silently accumulated ETH, resulting in the recent pump.

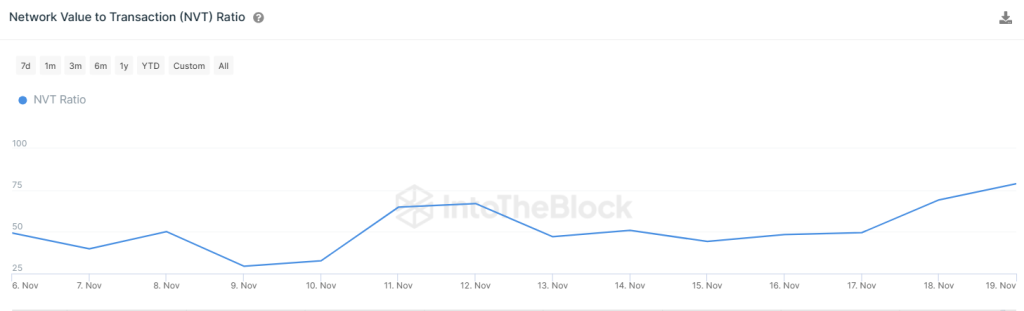

However, these whales might soon exit in a profit if the ETH price faces a setback in testing $2,100. The NVT ratio currently shows signs of overvaluation as it has been increasing, now at 78.83. This reflects that with the rise in ETH’s price, the network’s overall value is also climbing. However, Ethereum’s transaction activity has been relatively low this week. This trend hints that ETH’s price might be nearing an overvalued state and could face a correction near the $2.1K level.

The current Ethereum’s long/short ratio reflects a battle between the bulls and bears. If the bulls falter in their attempt to break through the $2,100 barrier, Ethereum’s price might experience significant liquidations. Latest figures show the long/short ratio at 0.9131, where buyers account for 47.7% of positions, while sellers hold a slightly higher 52.3% stake.

What’s Next For ETH Price?

Ethereum is currently encountering strong resistance near $2,050. However, a promising indicator is the bulls’ ability to keep the price above the 20-day exponential moving average. As of writing, ETH price trades at $2,025, surging over 3.5% from yesterday’s rate.

The upward trend in moving averages and the relative strength index (RSI) in the positive territory suggest that the bulls hold an advantage.

A successful breach above $2,160 might send the price towards $2,400. At this level, the bears might aggressively sell. A potential sign of bearishness would be a closure below the 20-day EMA, hinting at a likelihood of sideways movement in the short term. In that case, the price might hover between $1,850 and $2,000 for some time.

The 4-hour chart indicates a potential for a reversal from the resistance point. A decline from the trend line might send the price to consolidate just below $2K. However, it will weaken the resistance level, creating more chances of a breakout in the coming hours.