The post Ethereum Holds Momentum Near $1,800! Will ETH Price Make a Comeback Now? appeared first on Coinpedia Fintech News

Ethereum has been experiencing the brunt of the recent crypto market decline, which was sparked by Bitcoin. Even though the altcoin underwent a successful Shanghai upgrade and exhibited positive on-chain metrics, it has struggled to maintain momentum and persistently falls below essential support levels. Nevertheless, traders and market experts are optimistic that Ethereum has the potential to initiate a bullish turnaround, offering a glimmer of hope for an upcoming upward surge.

Ethereum Derivatives Suggests a Slowdown in Bearish Momentum

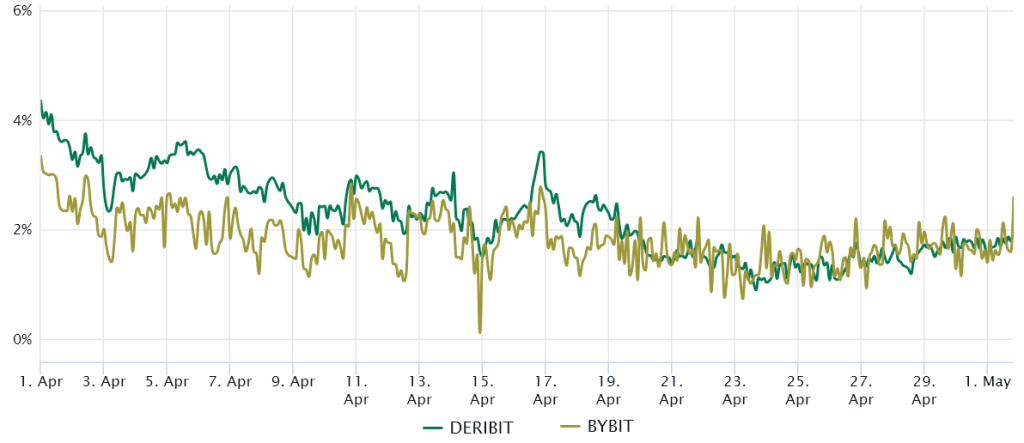

Ether quarterly futures have emerged as a favored instrument among major investors and arbitrage desks. These futures contracts, which allow for a longer settlement period, often command a modest premium over spot markets, reflecting the increased value sellers assign to deferred settlement.

In a well-functioning market, futures contracts can typically be expected to trade at an annualized premium of 5% to 10% – a phenomenon known as contango. It is important to note that this occurrence is not exclusive to the realm of digital currencies but is a common feature across diverse markets.

Since April 19, Ether futures premium has stalled at 2%, showing pros hesitating to change stance as ETH hits $1,950 resistance. A lack of demand for leverage longs doesn’t guarantee price drops, so traders should study Ether’s options markets to uncover how big players predict future price shifts.

At present, the 25% skew ratio stands at 1, signifying an equal valuation between protective put options and neutral-to-bullish calls. This development serves as a bullish signal, particularly considering the recent 8% correction in ETH’s price over a six-day period following its failure to breach the $1,950 resistance.

Crucially, current derivatives metrics disclose neither an overwhelming sense of fear nor the presence of excessively leveraged bearish bets, which implies a low probability of ETH revisiting the $1,600 support level in the near future.

What’s Next for Ethereum Price?

Ethereum’s price has been stuck between the 20 and 50-day EMA, suggesting an intense battle between bulls and bears. As of writing, ETH price trades at $1,861, with an uptick of over 1% in the last 24 hours. Currently, the ETH price hovers in a bearish range, with support formed at $1,780.

However, bulls quickly gained control near $1,800, pushing the price above the 23.6% Fib level. A breakout above the immediate resistance level at $1,930 will boost the upward momentum, and Ethereum may hover near $2K. As the RSI trendline has surged and currently trades at 46-level, it suggests that buyers are attempting to push the trading volume and network activity.

On the bearish side, Ethereum can trade near EMA-100 at $1,740 if it fails to hold its current range.