The post Bitcoin Price Retests Major Bull Market Support at $92k: $130k or $80k Next? Analysts Insights appeared first on Coinpedia Fintech News

Bitcoin (BTC) price has retested a crucial multi-year support trendline. The flagship coin dropped over 2% on Monday, to reach a range low of about $91,214 during the mid-North American session.

Bitcoin Price at a Crucial Crossroads

Bitcoin price has dropped around 20% in the past four weeks to retest its multi-month rising logarithmic trend. As CoinPedia recently reported, the BTC/USD pair was well-positioned to retest the support level around $92k to fill its multi-month unfilled CME gap.

Source: TradingView

In the weekly timeframe, Bitcoin’s Moving Average Convergence Divergence (MACD) has flashed a bear market. Notably, the weekly MACD has been registering rising bearish histograms as the MACD line teases crossing below the Zero line.

What’s Next for BTC Price Amid Extreme Fear of Capitulation?

Potential rubber-spring rebound fueled by a short-squeeze and renewed whale demand

From a technical analysis standpoint, the Bitcoin price is well-positioned to rebound quickly in the coming weeks. After closing last week in a bearish candlestick, BTC has suffered more selling pressure fueled by leveraged traders.

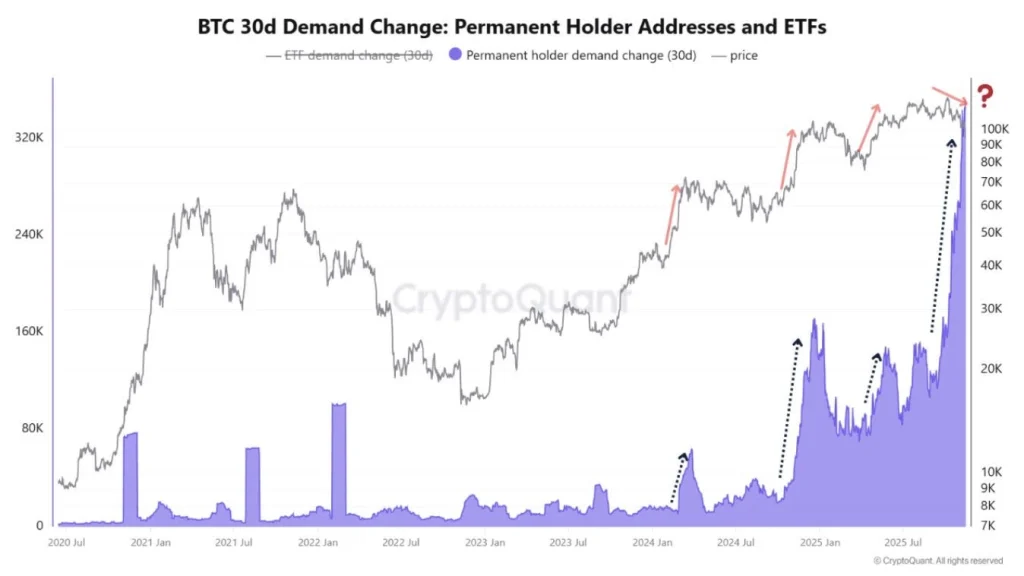

A potential short-squeeze is likely to trigger a rubber-spring rebound fueled by high demand from whale investors. According to on-chain data analysis from CryptoQuant, long-term capital, led by Strategy that acquired nearly 9k BTC, has been aggressively accumulating amid the ongoing selloff.

Source: CryptoQuant

The long-term whales are potentially betting on expected capital rotation from gold to Bitcoin in the coming weeks. Moreover, the upcoming Fed’s Quantitative Easing (QE) in December is a bullish trigger for the wider crypto market.

A possible beginning of a multi-month bear market

On the other hand, BTC price is likely to continue in bearish sentiment if whales fail to absorb selling sprees by short-term traders. If Bitcoin price consistently closes below $91k in the coming days, the onset of its multi-month bear market will be inevitable.

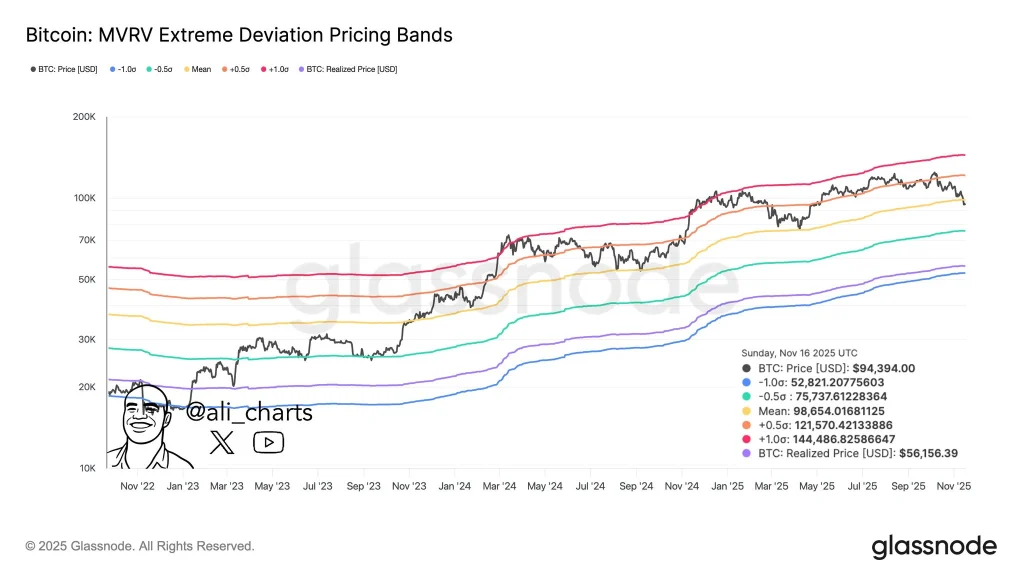

Source: X

According to market data analysis from Glassnode, the Bitcoin price will likely fall below $80k if the bullish thesis fails to materialize in the coming days.