The post Solana Gains Over 10% Amid Declining On-Chain Activity! Here’s What To Expect Next appeared first on Coinpedia Fintech News

The Solana network is struggling to maintain its on-chain activity amid declining trading interest. Recently, the crypto market witnessed a crash that led to a price correction for SOL, driving its value towards support levels. Although SOL’s price later rebounded, the continuous low on-chain data is causing concerns among investors about the sustainability of this upward movement.

Solana Faces A Drop In New And Active Addresses

In the past 24 hours, the price of SOL experienced a significant increase, resulting in a substantial wave of liquidations by sellers. Data from Coinglass reveals that there was a total of $13.2 million in SOL liquidations, with approximately $9.5 million of that amount coming from the liquidation of short positions.

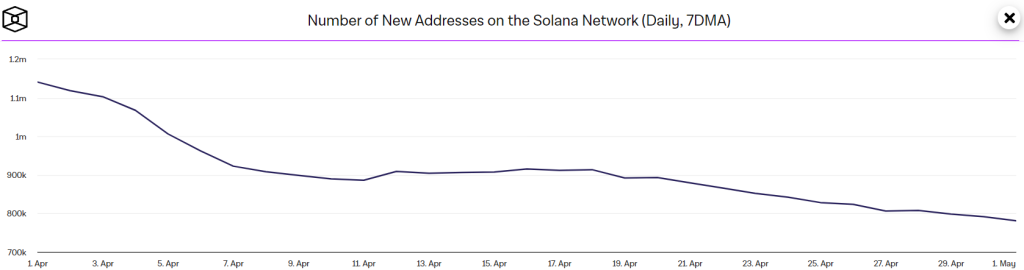

The Block’s data dashboard reveals that the Solana blockchain has seen a notable decrease in new addresses recently. Over the past 15 days, the number of new addresses fell by 14.7%, dropping from a weekly high of 915,000 to 780,000.

Also read: Solana On The Verge Of A Breakdown! SOL Price To Hit $100 This Week?

Typically, a robust influx of new addresses is a sign of healthy network growth and increased utility, which in turn can boost Solana’s value. Conversely, a slowdown like the current trend can trigger concerns among investors, as it might reflect issues such as declined appeal of the blockchain, potential technical challenges, or increased competition from other blockchain platforms. Thus, SOL price might struggle in its ongoing recovery efforts.

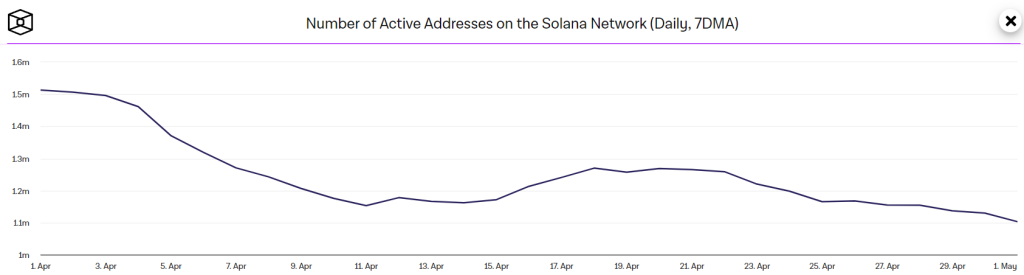

Additionally, the decrease in the number of active addresses on the Solana blockchain, from a peak of 1.21 million to 1.1 million, further impacts the SOL price negatively. This decline suggests declined user engagement and transaction activity, which can weaken investor confidence and potentially lower the demand for SOL.

Analysts anticipate that the current recovery in SOL price may soon stall as it approaches resistance channels without sufficient buying pressure, potentially leading to a reversal for Solana.

What’s Next For SOL Price?

The inability of bears to halt a rebound at $120 for Solana indicates that bulls continue to dominate the market. Bulls continue to break above immediate Fib channels and push the SOL price toward its crucial resistance near 200-day EMA at $150. However, sellers are expected to strongly defend a surge above that trend line. As of writing, SOL price trades at $138, surging over 11% in the last 24 hours.

On the bearish hand, there is slight support at $116-$120, yet if this threshold is breached, the pace of selling may intensify, potentially driving the SOL/USDT pair down to $100. A deeper drop might delay the onset of the next upward trend.

For bulls to regain momentum, they need to quickly send the price above the 200-day EMA, currently at $150. This move could catch aggressive bears off guard, potentially triggering a short squeeze. Following this, the pair might target the 50-day SMA at $166.