The post XRP Price Enters Accumulation Phase as CVD and Funding Rates Rebalance appeared first on Coinpedia Fintech News

XRP price is beginning to show early signs of stabilization after an extended corrective phase, with on-chain data now suggesting that market structure is quietly shifting beneath the surface. While price remains well below recent highs, volume behaviour and derivatives positioning indicate that the current phase looks less like active distribution and more like a developing accumulation zone, a transition that often precedes broader trend reversals.

The question facing the market is no longer about downside momentum, but whether demand is finally starting to absorb the remaining supply pressure.

On-Chain Flows Suggest Demand is Returning

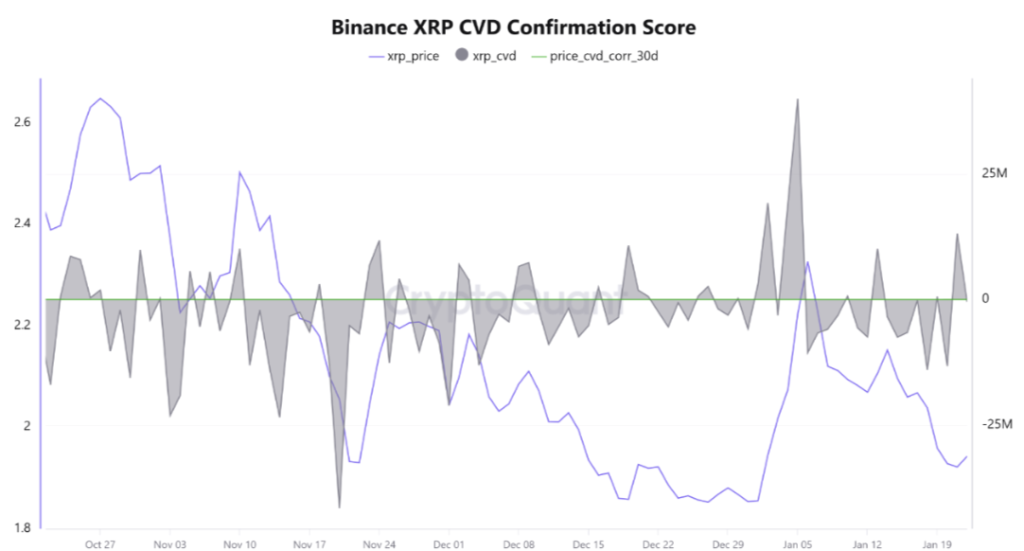

On-chain volume dynamics point to a subtle but important change in XRP’s internal structure. Data shows that the 30-day correlation between XRP price and cumulative volume delta (CVD) currently sits around 0.60 to 0.62, reflecting a moderate-to-strong positive relationship between price action and net trading flows. In simple terms, recent price movements are still being supported by real volume participation, not thin liquidity or isolated speculative activity.

This matters because distribution phases typically show the opposite behavior: price continues to move while volume support weakens, creating a divergence between market perception and actual demand. That decoupling is not visible here.

Instead, XRP’s price structure remains aligned with volume behavior, suggesting that selling pressure is being absorbed rather than reinforced. Even though the absolute CVD reading remains slightly negative, this does not invalidate the signal. CVD in this context acts more as a trend quality indicator than a short-term trading trigger. It measures whether price movement is structurally justified by flow, not whether the market is ready for an immediate breakout.

The persistence of positive price–volume correlation during a corrective environment points toward a market that is gradually shifting into a base-building phase, rather than one that is still undergoing aggressive distribution. From an on-chain perspective, this is closer to accumulation mechanics than continued structural weakness.

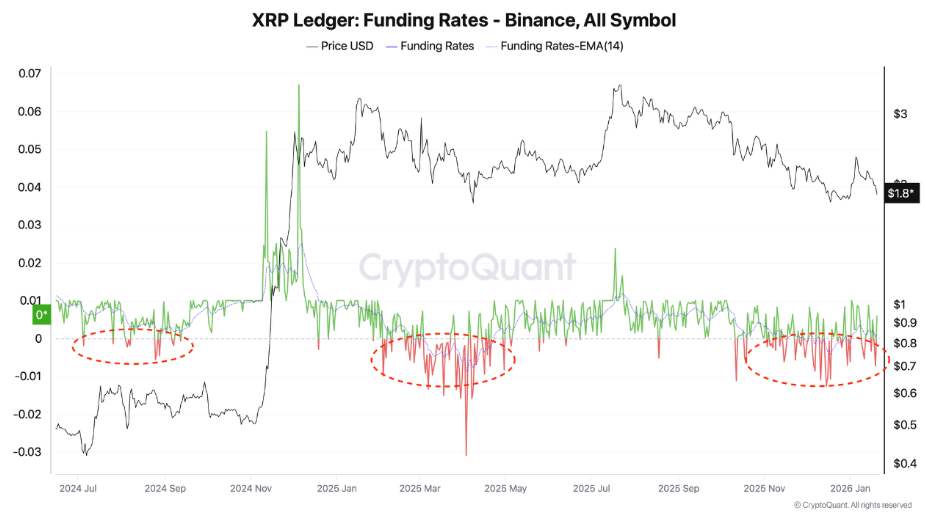

Funding Rates Highlight Market Scepticism

Funding rates across major perpetual markets, particularly on Binance, have remained consistently negative since December, showing that leveraged traders continue to favor short exposure. However, this bearish consensus formed well after XRP had already corrected sharply from its recent highs. While negative funding does generate short-term selling pressure, it also creates a growing pool of forced future demand, as short positions must eventually be closed.

This places XRP in a positioning environment where downside conviction is already crowded, while upside moves carry asymmetric impact. Even modest price recoveries can trigger systematic buybacks through short liquidations and funding rebalancing.It is confirming market scepticism in a structure that is no longer actively breaking down, a configuration that often marks early transition zones rather than continuation.

XRP Price Tests Breakout Zone: Reversal Imminent?

In the early 2026, XRP price has registered a breakout of the falling wedge pattern and is currently retesting the breakout zone near $2 to form a shallow base. This structure suggests that selling pressure is gradually easing, with volatility compressing. With XRP price stabilizing near the demand zone, it may form its next bullish leg toward $3 in the near sessions. Moreover, the momentum is no longer accelerating downward, instead buyers are stepping in gradually and accumulate at lower levels.

Until XRP price holds the demand zone of $1.80-$2, the bullish structure remains intact and a sustained hold of this zone would open the door for continuation toward higher liquidity zones, confirming that accumulation has transitioned into expansion.